The Pervasive Vulnerability of Life in America (updated 20 April 2025)

Approaching tipping points in a system that fails the citizenry

This essay was originally published on 9 January 2025, just eleven days before the presidential inauguration. At the time there was an intensive focus on the assassination of Brian Thompson, the CEO of UnitedHealthcare, and much of the resulting commentary cast a spotlight on the unsympathetic social response that reflected dismay with how health insurance is handled in the U.S. The essay sought to identity a range of other concerns that together leave American citizens highly vulnerable with regard to health, safety, and financial well-being.

In the 90 days that has passed since January 20, 2025—inauguration day—the range of issues that American citizens and residents have to worry about has increased, amplifying and adding to their already extensive list of existential concerns.

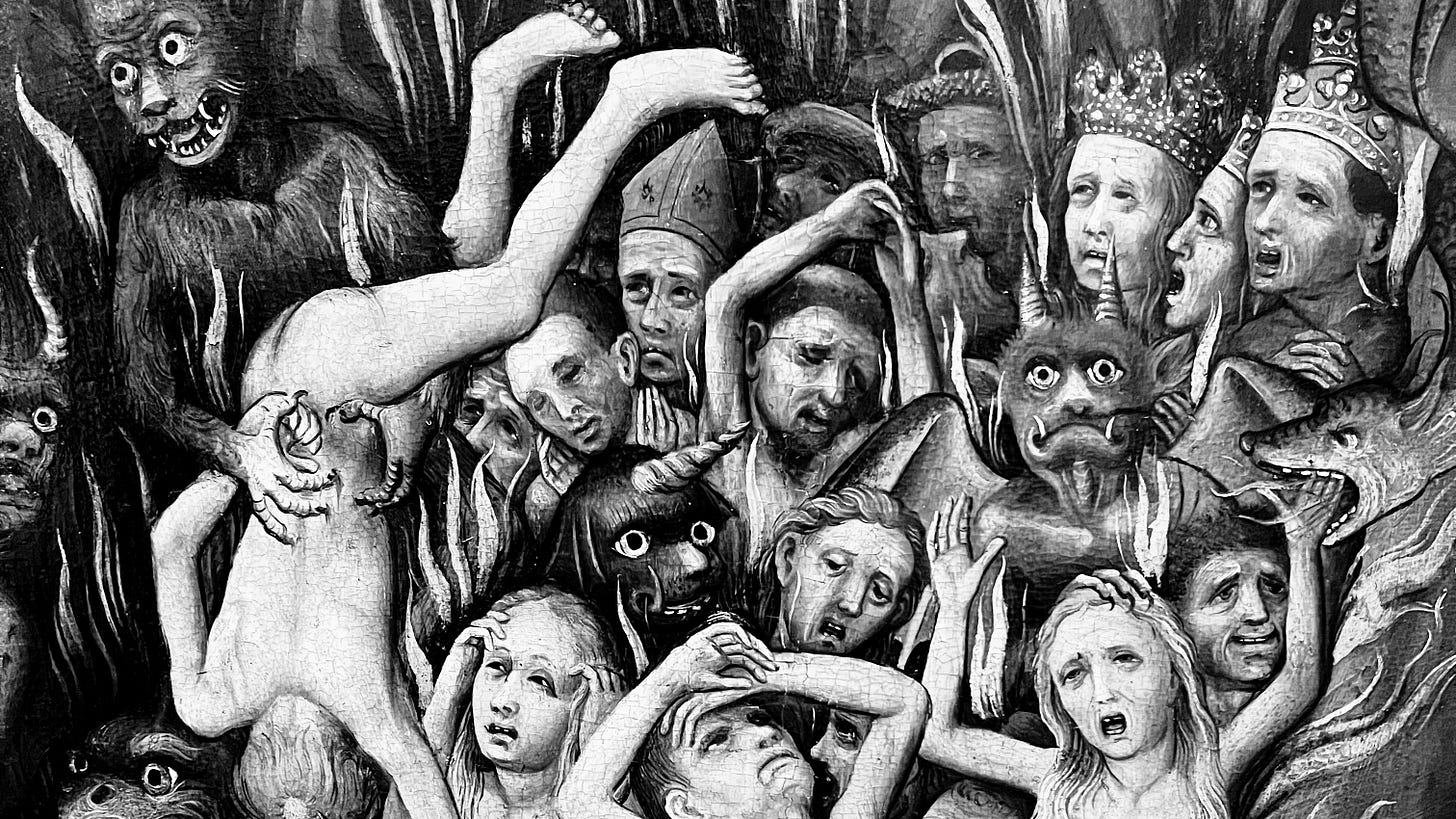

This update focuses on identifying the many issues that contribute to the vulnerability of American citizens and residents. Virtually all new concerns represent policy actions by the federal government’s Executive branch. Not all create a life or death situation—though some policies clearly lead in that direction. In aggregate the list is formidable, creating a collective sense of insecurity, frustration and fear that makes reaching a tipping point over any one issue more likely.

If you’re looking for a short read scan the headings and read the conclusions. The issues are complex and are identified rather than analysed. They also have a few things in common: they are issues that either hardly exist or exist at lesser degrees of intensity in most other countries of the developed world; they all embody some tension between what is systemic (in business, finance, healthcare, etc.) on the one hand, and personal choice and responsibility on the other; and they all affect personal well being.

Consider the weakening of constitutional norms.

The Executive branch’s challenges to basic tenets of the U.S. constitution are weakening the balance of governmental powers, particularly as the congressional branch has in effect ceded its constitutional authority to the Executive. The justice system continues its role as a check on executive power, but its authority has been consistently ignored or denied by the Executive. For individual citizens and residents of the country, however, it is the undermining of the foundation of American liberty—due process under the law—and provides the greatest tangible threat to the concept “life, liberty and the pursuit of happiness.” The trajectory is clear, even if the endpoint is not yet in sight.Consider the violent tenor of life.

In the U.S., gun violence is perhaps the most widely debated public-health menace: The provisional CDC figure for deaths from firearms in the U.S for 2023 is 46,728, of which 27,300 (or 58 percent) were suicides. Of all deaths classified as murders, 81 percent were caused by firearms.1 While individual deaths by gunshot might only be publicised at a local level, mass shootings—particularly at schools—gain national and international attention, heightening the public’s sense of vulnerability even more than the far more frequent individual shooting deaths.

Public opinion on gun ownership is divided: some feel that gun ownership increases safety, others that it has the opposite effect.2 Notably, the common ground on both sides is fear for personal security.Consider the assault on scientific research and higher education.

The Executive branch of government has brought pressure on the the country’s leading research universities to, in effect, cede institutional governance to the federal Executive and its agencies, and to relinquish the constitutional right to free speech and the tradition of academic freedom. It has suspended or withdrawn federal research funding regardless of potential benefits to American society, undermining research activity across the spectrum, from science to the humanities and the creative arts. It has threatened to prohibit the engagement of foreign students through the suspension or refusal of visas, and even now threatens suspension of tax-exempt status as a punishment to institutions that do not bend to the Executive’s will.Consider the assault on public health.

The assault on research universities runs parallel to the undermining and destruction of the federal government’s own agencies that assure public health and safety. There is a long and growing list of entities whose ability to protect the American public has been compromised by budget cuts, reductions in staffing and investment, and the appointment to leadership positions of individuals hostile to the institutions’ missions: The Centers for Disease Control and Prevention; the National Oceanic and Atmospheric Administration; the Federal Emergency Management Agency; the Department of Health and Human Services; the National Institutes of Health; the Food and Drug Administration; the Environmental Protection Agency; the Occupational Safety and Health Administration; and the Veterans Administration. This is a partial list, reckoned less than three months after the installation of the current Executive.Consider the issue of student loan debt.

Some 43 million individuals in the U.S. owe, collectively, $1.77 trillion for educational loans; average debt per individual is approximately $38,375 (third quarter of 2024); new loans now average in aggregate nearly $100 billion annually. While such debt might be reasonably associated with college-age students, changing learning patterns and challenges in meeting repayment obligations mean that this debt is sometimes carried even into retirement age, thereby constraining individuals’ ability to save for a secure income in their senior years (a staggering $400 billion is owed by Americans over age 50).3Consider the issue of other forms of debt.

Mortgage debt? At the end of the third quarter of 2024 there were 51,263,000 outstanding mortgage loans with an aggregate debt of $11.974 trillion; average interest rate was 4.3% with an average monthly payment of $1,898.4 Other forms of debt can also cause defaults on mortgage payments—322,103 foreclosure filings took place in 2024.5

Automobile loan debt? About one-third of the U.S. population is currently paying off a loan for an automobile purchase—the are about 100 million outstanding loans. This covers loans for both new and used cars; average interest rates depend on credit scores, but in the third quarter of 2024 the average for new cars was 6.61% and 11.74% for used cars; average monthly payments were $737 and $520, respectively.6

Credit card debt? In May 2024 credit card debt in the U.S. had reached $1.27 trillion, or $10,479 per American household. Average interest on credit card debt in 2024 was 22.76%7—a figure I’d tend to associate with mob loan sharks of the 1960s.

Medical debt? Medical debt now totals about $220 billion, affecting 14 million Americans who owe at least $1,000 and 3 million owing more than $10,000.8 The November 2024 West Health-Gallup Healthcare Survey indicated that 12 percent of adult Americans, or about 31 million individuals, had borrowed money to pay for medical expenses—with loans totalling an estimated $74 billion.9

School lunch debt? Children of low-income families may benefit from the National School Lunch Program (NSLP),10 but many who do not qualify continue to borrow from schools to pay for meals.11 Aggregate school lunch debt nationally is currently reckoned at $176 million per annum, and most school districts report that the number of children in need increases annually. Unpaid debt generally becomes the responsibility of individual school districts, not the major corporations to whom the catering of school meals is frequently contracted. Among developed countries, this category of debt is unique to the United States, so there are no international statistics for comparison.Consider the issue of cost of living. Cost of living varies by state within the U.S. In aggregate, however, using the OECD’s ordering by price level index,12 The U.S. ranks fourth among OECD countries in cost of living, just after Israel, Switzerland, and Iceland.13 In other words, the U.S. has become one of the most expensive countries in the world in which to live.

Consider personal bankruptcies. While the average number of filings for personal bankruptcies in the U.S. varies from year-to-year. As of 30 September 2024. the number of personal bankruptcies for the preceding year was 481,350, 1 15.5 percent increase over the previous year.14 The major cause of such bankruptcies is medical debt: evidence indicates that medical debt is cited in more than 65 percent of all bankruptcy filings.15 Other contributing factors include all of the other types of debt referred to above, as well as job loss and natural disasters.

Consider the issue of homelessness. The is no single statistic that accounts for the number of homeless people or families in the U.S. There is, however, sufficient evidence that homelessness affects about 1.25 million Americans annually. The United States Interagency Council on Homelessness notes that “Housing is a social determinant of health, meaning lack of it has a negative impact on overall health and life expectancy. Tens of thousands of people die every year due to the dangerous conditions of living without housing—conditions that have worsened due to climate change’s rise in extreme weather. People who experience homelessness die nearly 30 years earlier than the average American—and often from easily treatable illnesses.”16

These issues of personal debt and economic well-being are exacerbated by the federal Executive’s economic actions as well. The erratic imposition of tariffs adds to consumers’ tax burden while diminishing choice in the marketplace of goods. The consequences of the arbitrary and inconsistent implementation of tariff policy has also shaken global economic confidence in the U.S. and rattled stock markets globally. Moreover, since inauguration day the value of the U.S. dollar has plunged by at least nine percent against selected global currencies. The immediate consequences include decline in the value of market-linked consumer investments, such as 401(k) retirement vehicles, and higher prices for imported goods—which, in effect, amplify the domestic impact of tariffs. Concerns over the longer-term outlook include inflation, the potential for an economic recession, and am eventual shift away from the US dollar as the global reserve currency.

Let’s also think about personal security in old age. This is a big topic since it applies directly to all working Americans who hope and expect someday to retire, not just the approximately twenty percent of Americans aged 65 or older. It applies to everyone who has ever paid Social Security taxes, opened a simple IRA, or who pays into a retirement savings account—and especially to those who earn too little to save effectively for the future.

Consider defined benefit pensions versus defined contribution plans. When I was hired in my first “serious” job in 1979, my retirement package consisted of a defined benefit pension17 programme that was structured to promote staff retention, but which also encouraged retirement at age 65: the pension consisted of an annuity whose value would rise to its maximum value at age 65, and decline thereafter. But a new form of retirement savings was inaugurated in 1978 under section 401(k) of the Revenue Act of 1978, and soon thereafter my employer began to transition its staff retirement programme in the direction of this type of retirement savings. These plans are called “defined contribution plans.”18 The argument presented to employees was that it would give individuals greater control over how retirement funds were invested, and seminars were offered to introduce staff to basic investment concepts so that they could become, to the extent possible, their own investment managers.

In effect, the money set aside in defined contribution plans provides funds for speculative investment by financial management firms, primarily in capitalist enterprises. Workers therefore live with the vulnerabilities of the investment market, knowing that in retirement their income will depend on the health of the commercial world, the overall stability of the economy, and the continuation of perpetual economic growth. For those of us monitoring our 401(k) or equivalent investments in 2008 and 2009, a lesson in planning for future income was learned: you can’t count on it. You’re vulnerable to “the market” and the ups and downs of the national and global economies.

Consider Social Security. The topical outrage around health insurance has struck most politicians dumb, but many Republicans are still vocal about seeing an opportunity to re-conceive the Social Security programme, by privatising it (making it vulnerable to “the market”), changing the terms for qualifying for payments, or eliminating it altogether. Again, the rhetoric around Social Security is nothing new. We have been reminded continuously of its vulnerability—that the fund will hit a wall in 2035 and be forced to reduce payouts to 75 percent of prior amounts if no action is taken to reinforce it.19

These are concerns that impact Americans’ income once they reach retirement age. A 2024 survey by Greenwald Research indicates that 79 percent of all Americans believe there is a retirement crisis in America, with a majority fearing financial insecurity after leaving the workplace.20 With good reason: According to the Congressional Research Service some 46 percent of Americans have no defined contribution plan or IRA,21 and in 2022 the most optimistic estimate of median retirement savings for the age group 55-65 was just $185,000.22

The list of issues that make U.S. residents vulnerable continues with a few other key elements that affect one’s personal security and sense of vulnerability. These include:

Job security: In the U.S. employment is generally governed by the doctrine of “employment at will,” whereby either employer or employee may terminate employment at any time, subject to certain constraints (which could include an employment contract or collective bargaining agreement).23 The doctrine provides significant empowerment to an employer in managing a workforce, but creates vulnerability for employees for whom employment is linked to both income and, in many cases, health insurance and the building of retirement assets. Because “employment at will” is simply the status quo, the power imbalance between employer and employee is simply taken for granted, even though for many it adds to an ongoing sense of insecurity and vulnerability. (By comparison, in the European Union the “contract of indefinite duration” is the basis of most employment, which provides significant protections to employees, including the right to continued healthcare benefits if a job is terminated.)

Environmental security: Citizens expect protection from environmental dangers, whether they be created naturally or through social (human) activity. Government action to protect the citizenry lies within the purview of the U.S. Environmental Protection Agency, which has declared its intention to roll back 31 key regulations while also announcing the dismissal of some 400 employees. The future of the Federal Emergency Management Agency (FEMA) is unclear, with Homeland Security secretary Kristi Noem declaring the DHS intended to eliminate the agency. The future of the National Oceanic and Atmospheric Administration (NOAA) is similarly uncertain. Project 2025 calls for its elimination as a federal agency and privatisation of its functions; cuts to staffing and termination of leases for its facilities would appear to be harbingers of the realisation of this objective.

Food security: What confidence should there be in the safety of consumed goods under an incoming administration whose mantra is less regulation? And what about food availability? Consider that in 2022, 54.9 percent of fruit and 29.3 percent of vegetables consumed in the US were imported24—a large proportion of which originate in countries targeted for punitive U.S. tariffs. And there are deep concerns that the incoming U.S. administration’s stated plans for mass deportations would have widely felt impact on native U.S. food production and therefore on food availability and prices.

Information security in general: Confidence in information received should be based on verifiable data, whether the data be recorded from observations (including all manner of statistical data about American society), experimentation (consider vaccines, or the case of artificial intelligence), or simulations (such a climate forecasts). But confidence is easily undermined simply through rhetoric, whether it be the false claims of politicians or misinformation disseminated by hostile governments. In the words of Jack Weinstein, “The greatest existential threat to the United States of America is the fracturing of our democracy and the intentional misleading of facts to support political agendas.”25 Pervasive distrust of information leads one to fall back on some act of faith in the source one chooses to believe, making it ever more difficult to speak truth to the population at large.

Security of personal information: European privacy laws, and indeed the General Data Protection Regulations (GDPR) of the European Union, are far more comprehensive than US data protection regulations. The framework regulates the roles of all parties that handle personal information, observing seven key principles: lawfulness, fairness, and transparency; purpose limitation; data minimisation; accuracy; storage limitation; integrity and confidentiality; and accountability.26 European nations have been particularly vigilant to the abuses of personal data, given how centralisation of personal data at national scale facilitated the abuses of fascist governments during World War II, and thereafter of Eastern Bloc nations (such as were perpetrated by the Stasi in East Germany) as well. The GDPR, however, also responds to the immense threat posed by the ease of collection and sharing of personal data and information across digital networks and platforms.

The U.S., by contrast, has no comprehensive national privacy policy or enforcement framework. Rather, regulations and enforcement exist at federal and state level, and by consensus within certain industries. Moreover, a major concern that the European GDPR attempts to address—the aggregation of and commerce in personal information without specific user consent—is largely unregulated in the US. Americans may experience the impact of the lack of regulation at various levels, particularly in marketing and advertising. It is such aggregation, however, that potentially enables an easy transition from profiling to enhance online services, to gathering of data to create political profiles—just think of the Facebook–Cambridge Analytica scandal.27 In the hands of authoritarian governments seeking absolute power, such information can also be harvested to identify state “enemies” and lead to their harassment or prosecution.

Some conclusions

In the first 100 days of the new Executive administration, a number of the issues identified earlier have worsened and a host of new issues has emerged. Much of the latter represent implementation of actions called for the the Heritage Foundation’s Project 2025—extreme protectionism, silencing of opposition to administration policies and practices, denial of climate change, and hostility to the very concept of democratic governance in favour of oligarchy and privatisation of publicly held assets. The country’s public health research services and investment in medical and scientific research has been curtailed, the regulatory apparatus to protect Americans against natural and man-made risks has weakened, and the federal funders of libraries and the humanities have been gutted. Within a short timeframe, the value of market-linked assets has plummeted, the dollar has lost significant value against other currencies, the risk of inflation and even recession has increased, the cost of consumer goods has continued to rise, due process under the law has been ignored, and the country has expanded its concentration camps from Guantanamo to a Salvadorian gulag.

The country has lost credibility and trust from long-time allies and the dollar as international reserve currency is under threat. Tourism is declining both through public perception and the warnings of a growing number of countries of potential liabilities in travelling to the United States. Even the nation’s flagship research universities are under attack for not yielding governance to the Executive administration and federal agencies.

Many of the other issues identified above are not unique to the United States, but what sets the U.S. apart is how extreme the issues of personal safety and well-being are compared to the rest of the developed world. All of these quantifiable issues affect the quality of human lives. In U.S. culture they are incessantly amplified or distorted, often along partisan lines, by a relentless stream of diverse media. They create a drumbeat of blame and anger that compounds society’s sense of vulnerability, if disenfranchisement,28 even of victimhood, and creates intense political divisions.

The apparent divisions and anger across the political spectrum mask a profound irony: surveys indicate that the majority of Americans agree on the need for remedies to many of the issues identified here, including some greater level of gun control, the continuation of programmes such as Social Security, Medicare and Medicaid, and reform of the current approach to costs and availability of healthcare. Much of what is being delivered instead was identified in Project 2025; the impact has been immediate, and devastating.

John Gramlich, “What the data says about gun deaths in the U.S.,” Pew Research Center Short Reads (26 April 2023) https://www.pewresearch.org/short-reads/2023/04/26/what-the-data-says-about-gun-deaths-in-the-u-s/ (consulted 15 December 2024)

Katherine Schaeffer, “Key facts about Americans and guns,” Pew Research Center Short Reads (24 July 2024) https://www.pewresearch.org/short-reads/2024/07/24/key-facts-about-americans-and-guns/ (consulted 17 December 2024)

“Portfolio by Age,” Federal Student Loan Portfolio (2024) https://studentaid.gov/data-center/student/portfolio (consulted 15 December 2024).

“NMDB Outstanding Residential Mortgage Statistics Summary: United States, All Mortgages as of Quarter 4 of 2024,” National Mortgage Database (NMDB®) Aggregate Statistics Dashboard, https://www.fhfa.gov/data/dashboard/nmdb-aggregate-statistics (consulted 19 April 2025)

“U.S. Foreclosures Declined in 2024, Indicating Market Stabilization,” ATTOM (undated, [2025]) https://www.attomdata.com/hnr/u-s-foreclosures-declined-in-2024-indicating-market-stabilization/ (consulted 19 April 2025)

Ben Luthi, “Average Car Loan Interest Rates by Credit Score,” (14 October 2024), Experian https://www.experian.com/blogs/ask-experian/average-car-loan-interest-rates-by-credit-score/ (consulted 16 December 2024)

“Study: U.S. consumers continue to rack up credit card debt,” ABA Banking Journal (8 July 2024) https://bankingjournal.aba.com/2024/07/study-u-s-consumers-continue-to-rack-up-credit-card-debt/ (cnsulted 16 December 2024).

Shameek Rakshit, Matthew Rae, Gary Claxton, Krutika Amin, and Cynthia Cox, “The Burden of Medical Debt in the United States,” KFF (12 February 2024) https://www.kff.org/health-costs/issue-brief/the-burden-of-medical-debt-in-the-united-states/ (Consulted 16 December 2024)

Ellyn Maese and Dan Witters, “Americans Borrow Estimated $74 Billion for Medical Bills in 2024,” Gallup: Social & Policy Issues (5 March 2025) https://news.gallup.com/poll/657041/americans-borrow-estimated-billion-medical-bills-2024.aspx (consulted 16 April 2025)

U.S. Department of Agriculture, Economic Research Service, “National School Lunch Program” (updated 25 November 2024) https://www.ers.usda.gov/topics/food-nutrition-assistance/child-nutrition-programs/national-school-lunch-program/ (consulted 19 December 2024)

Hanson, Melanie. “School Lunch Debt Statistics” EducationData.org (23 November 2024)

https://educationdata.org/school-lunch-debt (consulted 19 December 2024). Hanson werites: “Many of those children who owe school meal debt are part of families who earn too much to be considered for free or reduced lunch, but also earn too little to afford regular school meals.”

Price level index (PLI) is defined by Eurostat as follows: “The price level index, abbreviated as PLI, expresses the price level of a given country relative to another (or relative to a group of countries like the European Union), by dividing the Purchasing power parities (PPPs) by the current nominal exchange rate.” Statistics Explained: Glossary:Price level index (PLI) https://ec.europa.eu/eurostat/statistics-explained/index.php?title=Glossary:Price_level_index_(PLI) (consulted 16 December 2024)

“Price level indices Comparative price level indices are the ratios of purchasing power parities to market exchange rates,” OECD https://www.oecd.org/en/data/indicators/price-level-indices.html (Consulted 16 December 2024)

“Bankruptcy Filings Rise 16.2 Percent,” United States Courts (7 November 2024) https://www.uscourts.gov/data-news/judiciary-news/2024/11/07/bankruptcy-filings-rise-162-percent (consulted 16 April 2025)

Himmelstein DU, Thorne D, Warren E, Woolhandler S. “Medical bankruptcy in the United States, 2007: results of a national study,” Am J Med. (2009 Aug;122(8):741-6) doi: 10.1016/j.amjmed.2009.04.012. Epub 2009 Jun 6. PMID: 19501347.

“Homelessness Data & Trends,” United States Interagency Council on Homelessness ([2022[) https://usich.gov/guidance-reports-data/data-trends (cnosulted 16 December 2024)

See the Internal Revenue Service definition, which describes defined benefit pensions as a retirement income programme designed to “provide a fixed, pre-established benefit for employees at retirement.” Defined benefit plan,” Internal Revenue Service https://www.irs.gov/retirement-plans/defined-benefit-plan (consulted 18 December 2024)

The U.S. Securities and Exchange Commission describes defined contribution plans os one that “that does not promise a specific payment upon retirement. In these plans, the employee or the employer (or both) contribute to the employee's individual account. The employee bears the investment risks.” See: “Defined Contribution Plan,” The U.S. Securities and Exchange Commission https://www.investor.gov/introduction-investing/investing-basics/glossary/defined-contribution-plan (consulted 18 December 2024)

Stephen C. Goss, “The Future Financial Status of the Social Security Program,” Social Security Bulletin, Vol. 70, No. 3 (2010) https://www.ssa.gov/policy/docs/ssb/v70n3/v70n3p111.html (consulted 15 December 2010)

Dan Doonan and Kelly Kenneally, |Retirement Insecurity 2024: Americans’ Views of Retirement,” National Institute on Retirement Security: Reports (February 2024) https://www.nirsonline.org/reports/retirementinsecurity2024/ (consulted 17 December 2024)

Congressional Research Service, “Ownership of Retirement Accounts in 2022: Amounts in Defined Contribution Plans and Individual Retirement Accounts” (29 July 2024) https://sgp.fas.org/crs/misc/R48143.pdf, p. 1 (consulted 18 December 2024)

Moriah Costa, “What's the Median Retirement Savings by Age?” Synchrony (30 July 2024) https://www.synchrony.com/blog/banking/median-retirement-savings-by-age (consulted 18 December 2024)

See: “At-will employment,” Wikipedia https://en.wikipedia.org/wiki/At-will_employment (consulted 20 December 2024) ; Charles J. Muhl, “The employment-at-will doctrine: three major exceptions,” Monthly Labor Review, U.S. Bureau of Labor Statistics (January 2001) https://www.bls.gov/opub/mlr/2001/01/art1full.pdf (consulted 20 December 2024)

Luis A. Ribera and Landyn K. Young, “Outlook of Fresh Fruits and Vegetables in the United States,” Center for North American Studies Reports, Texas A&M University Reports 2024-01 https://prod2.freshproduce.com/siteassets/files/advocacy/2024.01.outlook-of-fresh-fruits-and-vegetables-in-the-united-states-luis-final.pdf, p. 1 (consulted 15 December 2024)

Jack Weinstein, “POV: America’s Greatest National Security Threat: International and domestic disinformation campaigns targeting Americans a greater danger than nuclear capabilities of Russia, China, and North Korea,” BU Today: Voices and Opinion (3 June 2021) https://www.bu.edu/articles/2021/pov-americas-greatest-national-security-threat/ (consulted 15 December 2024).

“Quick Guide to the Principles of Data Protection,” Data Protection Commission [Ireland] (November 2019) https://www.dataprotection.ie/sites/default/files/uploads/2019-11/Guidance%20on%20the%20Principles%20of%20Data%20Protection_Oct19.pdf (consulted 17 December 2024)

“Facebook–Cambridge Analytica data scandal,” Wikipedia https://en.wikipedia.org/wiki/Facebook%E2%80%93Cambridge_Analytica_data_scandal (consulted 19 December 2024)

Disenfranchisement can mean a life suspended between debt and living a life of attachment to services rather than real goods or property. See William A. Finnegan, “Renting your life,” Substack: The Long Memo (19 April 2025) https://substack.com/home/post/p-161654331 (consulted 19 April 2025)

John, this is a powerful piece, quite sobering. perhaps a bit depressing. The current situation did not come about over night. It was not the work of one party over the other. It was 50 years or more of liberal/ neo-liberal policies of both parties and various elites. I know: don't mourn, organize!

This is an excellent summary of many of the extreme concerns I have about what's happening in the USA. Of course I feel a bit removed since my life is here and I'm also French, but still...

As regards higher education, I've been wondering if the deportation of foreign students involved in pro-Palestinian demonstrations movements isn't just the beginning of suppressing all campus protests, or at least funding to campuses who allow any protests to take place.